The Dijecus app is very convenient for customers and it enables to complete KYC process without visiting the bank!

The Dijecus platform is adoptable very easily by financial institutions (FIs). Additionally, 99% of the tasks are completed automatically by our Machine Learning intelli-bots.

The Dijecus solution is very cost-effective for both FIs and the customers. The whole process is completed by customer self-service and our intelli-bots

Dijecus is an intelligent, machine learning platform that provides a solution to the costly, slow, and troublesome process of KYC and Customer onboarding.

Financial Institutions (FIs) are facing a very long and cost-inefficient process when it comes to "know your customer" and "customer onboarding". The regulatory landscape is constantly changing. Costs are rising. Whereas customers are often annoyed by the procedures and requirements.

Dijecus mitigates and even eliminates these problems by bringing machine learning, purpose-built workflows and cost-efficient platform to the hands of the customers. It is a GDPR friendly that allows FIs and their customers to agree on their permissions. Provides means for fast and seamless validation of the customer's identity, politically exposed persons (PEP) declaration and serves as a process facilitator without storing customer identity information. Customer is the owner of their data. FI is the custodian of the customer data. Dijecus is the process enabler.

Request a demo!

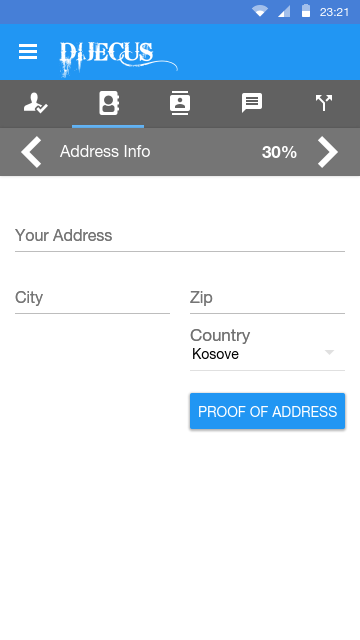

The customer goes through a very convenient process of registration and personal info verification.

Dijecus enables financial institutions to use machine learning to gather and attest the identity of their customers

Purpose-built workflow that encapsulates regulatory requirements in a turnkey solution

Customer is the owner of their data. The use of customer information is strictly controlled by the customer!

The Financial Institution is the custodian of the customer information, however seeks customer's approval prior to the use.

Dijecus is the process facilitator and does not store any customer identifiable information.

Once customer enters their information and attestation images, Dijecus validates through a smart machine learning algorithms. 99% of the info is validated automatically.

Through Dijecus platform, the financial institution can ask permission from the customer for a designated use. The whole process however is very convenent since it is conducted without bringing the customer on-premise.

Yes! The Dijecus platform does not store any customer identifiable information. The customer information is relayed to the fincancial institution implementing Dijecus, therefore enabling for GDPR ready.

Yes! Once the customer is validated through Dijecus platform, the financial institution can easily complete the customer onboarding process.